Fenina Aseniero (IV BS CTM), Miguel Abellada (IV BS Mgt), and Johann Dy (IV BSM AMF) are all stock traders. They are some of the few college students who now have investments in stocks of companies like the Philippine Long Distance Telephone Company (PLDT) and the Ayala Corporation.

Stock trading is the process of buying and selling shares of ownership (stocks) and other financial assets (bonds, mutual funds) of a corporation in the financial market. The investor earns profit by buying at a low price and selling at a higher price.

Better than saving

What started out as playing simulations in a mock stock trading game found in the Philippine Stock Exchange website soon became a real trading hobby with friends for Fenina. “My friend invited me to this investment club.” says Fenina, “We’re just a group of friends with a common interest—we talk about what to do with money. We basically learn from each other’s trading experiences.”

A self-confessed cautious trader, Fenina only puts her money in low-risk funds like mutual funds and balanced bonds in companies like Sun Life Financial, a leading organization in international financial services with key markets worldwide.

Miguel started trading stocks upon encouragement from his father, who is a stock trader. He started by buying IBM shares abroad. Soon after stricter measures were imposed on foreign investors, he shifted to local. He has been investing in stocks for seven years now.

Unlike Fenina and Miguel who limit themselves to online trading and investing for the long-term, Johann used to trade daily, monitoring changes in the stock market from 9:00 am to 12:10 pm, which are the trading hours in the Philippines. A confessed high-risk taker, Johann’s most significant gain happened when he earned roughly 20% in a day by buying at 9:30 am and selling at 12 pm.

Johann did not start trading stocks through the urge of family and friends, like Fenina and Miguel did. His strong interest in the field led him to reading books about stock trade like the works of renowned businessman and investor Warren Buffet. “When I turned 18, my gift to myself [was opening] my own stock trading account with BPI Trade,” says Johann. “From there I started to invest.”

His extensive knowledge and experience in stock trade is put to good use when he wins stock trading tournaments. He along with his group mates is now participating in the finals of the Global Investment Research Challenge, a competition sponsored by Chartered Financial Analysts Institute, an association of investment professionals.

The returns

According to the Philippine Stock Exchange Incorporation, only one-half to 1% of the population invests in the Philippine stock market. With a new age group entering the scene, the numbers are bound to increase.

Contributing to the local stock market aside, however, these students have their own reasons for engaging in stock trade.

“It’s better than leaving your money in the bank where it’ll earn, let’s say, 1% [per] year,” says Miguel. Taking after his dad’s mantra, he believes investing money is better than saving where money won’t grow.

As for Fenina, she doesn’t mind investing her shopping money during out-of-town family trips in a dollar fund, especially if it means earning her what she terms as passive income. She explains this as the money she gets to earn without even working yet.

In school, Fenina’s experience in stock trade has helped her truly understand the subject of finance the way school never taught her. “When I took Finance in school I was [confused]. But [when I started doing stock trade, everything] made sense. I was more connected [with] the numbers I read knowing that my money is in there,” says Fenina, pertaining to the financial statements she gets to read during stockholder meetings in her investment club.

In stock trading, there are different types of analysts. Fenina and Miguel fall under fundamental analysts where they invest based on studying the performance of different companies, as opposed to technical analysts who trade based on studying the general financial charts and trends of the stock market. Both Fenina and Miguel believe that this gives them an edge in getting to know future employers.

“Aside from earning money, you get to familiarize yourself with the different companies, kung alin yung mga magaling yung pagtakbo (which ones are ran well),” says Miguel. “So now, when I’m looking for a job, my knowledge of the companies helps.”

Fenina, meanwhile, uses her knowledge in stocks when meeting potential employers, most of which are her parents’ friends. “It’s a good conversation piece.” says Fenina, “Besides seeing how capable you are, upon them finding out you’ve been investing in their company they’ll go, ‘Hey, this person believes in our company.’”

No 100% successful trader

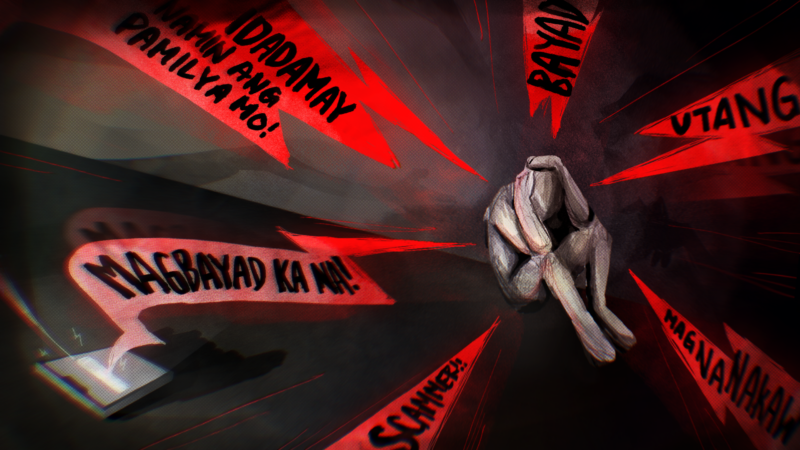

When asked if he approves of students trading stocks at a young age, School of Management Lecturer Emmanuel de Leon says, “I recommend [it] only to [those with excess] money and high risk appetites. Otherwise, it can be very stressful and addictive for students.” De Leon is also a day trader.

He differentiates students who trade from those who are already working. For him, some students might still treat trading as a game, not able to understand the real value of losing and gaining money. For people who work to raise a family like him, trading becomes a matter of either gaining or losing money that could be used to finance family needs.

The young stock traders agree that before engaging in stock trade, emotional stability, moderation, and knowing oneself are a must.

“Always have the right temperament,” says Miguel, who recently experienced losing roughly P25,000 from his stocks in Ayala Land because of the economic recession. “It is like imaginary money. Until you sell it, it’s not cash,” he says. “So for me, habang hindi ko pa binebenta yung talong price, hindi pa ko talo (while I haven’t sold the losing price, I haven’t lost yet).”

Cautious trader Fenina believes in always setting aside some money and diversifying her investments. “Never play with money you can’t afford,” says Fenina, “It shouldn’t be like gambling.”