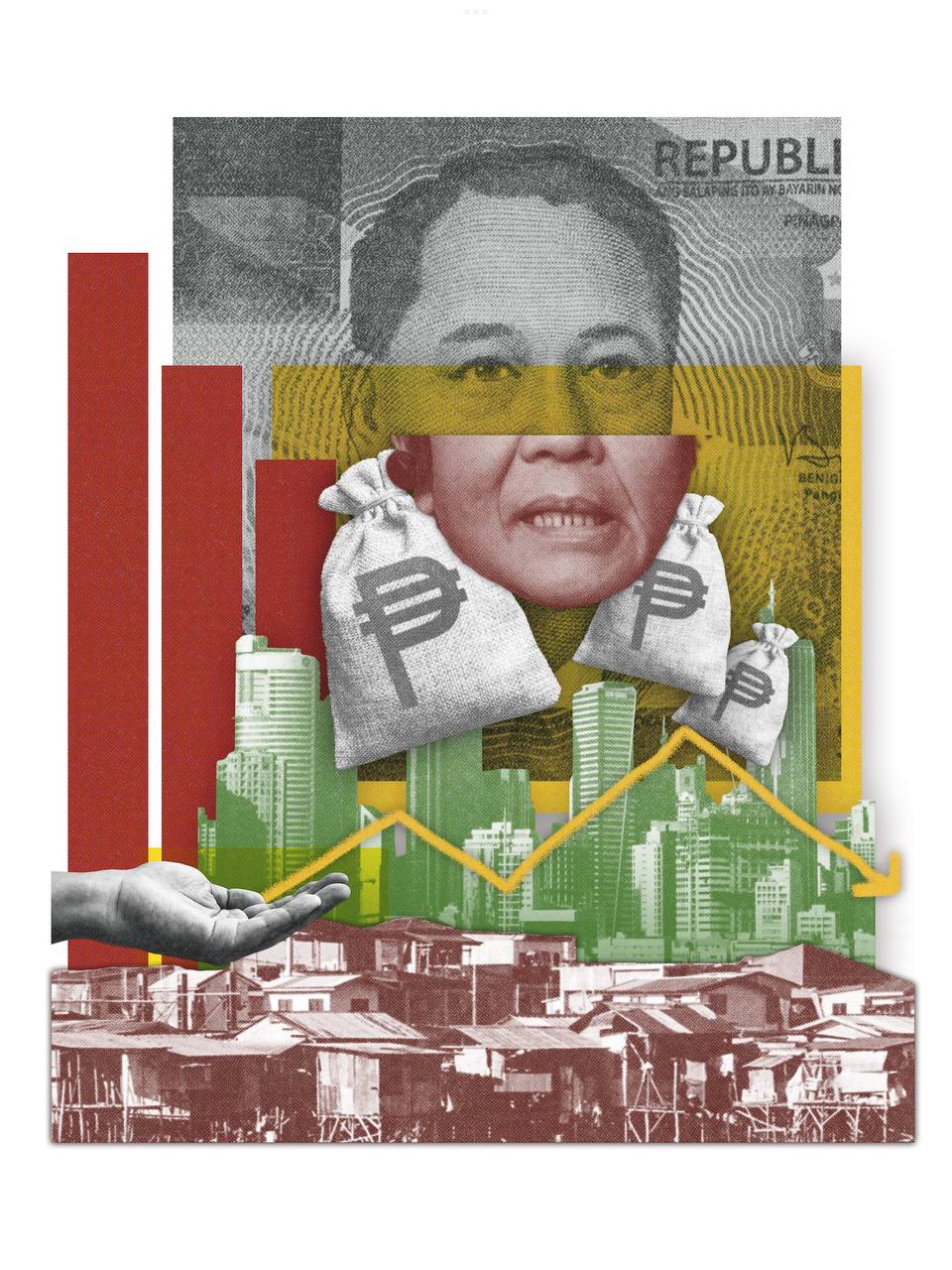

IN AN attempt to salvage the Philippine economy, President Ferdinand Marcos Jr. signed Republic Act No. 11954 or the Maharlika Investment Fund (MIF) Act. Under RA 11954, the administration will use the income from investments to support its economic goals via financial instruments, joint ventures, and high-impact infrastructure projects. Among other goals, the creation of the MIF is projected to grow national wealth, create jobs, and achieve food security.

However, how this will materialize still remains unclear as the Implementing Rules and Regulations (IRR) of the MIF have yet to be passed as of writing. As such, the positive outcomes speculated to arise from the MIF come alongside equally detrimental consequences.

Short-changed

In previous iterations of the MIF, various individuals raised concerns regarding its provisions pointing to governance and sources of capital money. Despite this, the administration’s economic managers have asserted that the MIF is a vehicle for economic growth through its ability to fund profitable socio-economic projects. In contrast, scholars from the Ateneo School of Government and the School of Social Sciences have found that other alternatives such as public-private partnership agreements are sufficient to achieve the MIF’s desired objectives.

Moreover, the benefits to be reaped from the MIF pale in comparison to the sovereign wealth funds (SWFs) of other countries. Australian National University Research Fellow Emerson Sanchez, PhD cited that SWFs are usually funded by profits from natural resources such as petroleum and minerals or citizens’ pensions funds managed as SWF. An example is the Alaska Permanent Fund (APF), which issues a regular payout to its constituents.

“In both cases, the ownership of the SWF belongs to the people and so the return of investment is directed to the citizens,” Sanchez emphasized.

Unlike the APF, the MIF will borrow from institutions, mainly the two government banks—the Landbank of the Philippines and the Development Bank of the Philippines—and the Bangko Sentral ng Pilipinas. As the SWF is not sourced from the citizenry, the return on investment (ROI) is not directly remitted to them either.

Sanchez explained that this may be an issue if the MIF fails—whether through incompetence or corruption—since the burden would fall on the Filipino to pay it back through taxes. “[There is] too much risk for citizens and too little to gain for them,” Sanchez added.

Apart from the issue of funding and ROI, the implementation of the MIF is an area of concern as well. Sanchez pointed out that some scholars view the SWF as a possible instrument for authoritarian governments to cling to power.

The governance of the MIF has come under question, too—the law designates the Finance Secretary as the chairperson of the Maharlika Investment Corporation, which is the body that will manage the MIF. In Sanchez’s view, this gives rise to a probable conflict of interest as the Finance Secretary holds influence in institutions that fund the MIF, such as the Landbank of the Philippines. Moreover, the chairperson could potentially be beholden to the president as a political appointee.

Personal stakes

Even with amendments, civic and migrant groups have warned that the MIF framework is not free of loopholes rife for exploitation. For instance, the law stipulates that three out of the nine members of the Board of Directors must come from the private sector in an independent capacity. According to Political Science Assistant Professor Arjan Aguirre, this stipulation is problematic as these members are not obligated to undergo transparency measures such as filing their Statement of Assets, Liabilities, and Net Worth (SALN).

“You can expect that [public officials] will adhere to the practices and ethics of being a public servant. However, for the private sector, this is not the case,” Aguirre remarked.

Furthermore, Aguirre mentioned that the oversight committee within the legislative body could politicize how the MIF will be carried out. Given that the majority of the members in Congress are aligned with the administration, decisions regarding MIF’s implementation are more likely to be friendly to partisan interests.

Overall, Aguirre opined that the government “has not been honest enough” about the susceptibility of the MIF to vested interests. He stressed that the media, the academe, and civil society groups must inform the public of the consequences that may possibly arise from the MIF’s complexity.

“The challenge there is to continue to be vigilant; people in power will be using the taxpayers’ money, and it will be up to their discretion how and where they wish to use it,” Aguirre said.

Counterbalance

In keeping up with the stakes raised, further provisions ensuring transparency and accountability on the government’s part can be put in place to effectively monitor MIF’s implementation. Although former president Rodrigo Duterte signed an executive order obligating officials to disclose their SALNs in 2016, Aguirre finds it lacking as it is only a directive. In the case of transactions carried out with the MIF, such information would have to be requested.

On the other hand, a Freedom of Information (FOI) law would prescriptively mandate public officials to publish information, according to Aguirre. This would ensure proper management of the MIF and penalize erring officials. Additionally, an open government policy would ensure the proper archiving of information.

“This will be important for the MIF because we will be using public money here; we don’t have excess funds these days. Hopefully, there’s a way where even the information they release has a system in place,” he said.

For that reason, empowering stakeholders gains paramount importance as it would enable the citizenry to actively monitor the MIF’s financial reports, vigilantly counterbalancing the potential misuse of funds. However, while concerns about the MIF’s lack of transparency continue to abound, the burden of remedying these—along with responsibility for the consequences in the event of failure to do so—ultimately still remains with its policymakers.