After 20 years of waiting, tax reform is now around. The Senate and the House of Representatives have passed their own versions of the first tax reform package, both with modifications from the original Department of Finance (DOF) proposal. Both packages feature income tax cuts for all except on the top bracket, increase on oil excise tax, additional tax on sugary drinks, and higher automobile taxes.

As of this time of writing, we’re waiting for the bicameral conference to finalize the details of the bill to be submitted to the President. While there’s some scepticism around on certain provisions of the first tax package as being allegedly anti-poor, there’s one aspect in which Congress deserves to be praised.

It’s about the proposed reform on the estate tax. To note, the House version proposes a flat 6% estate tax while the Senate version added exemptions on agricultural lands less than three hectares and properties worth Php 5 million and below together with the flat rate. This is a major step forward, but things could be done much better. The best solution to this is the abolition of the estate tax.

The concept of the estate tax is that it’s a “tax on the rich” mechanism. For example, in the conception of its modern form in 1916 in the United States, politicians imposed this tax in order to prevent the concentration of wealth into the hands of the few. Back in those days, rich people primarily made their wealth through vast land holdings which then will be inherited by their family members. However, the economic realities of today have debunked this argument. The top 1% are known for having diversified sources of wealth and relying on passive income such as stocks and real estate in order to build their portfolio.

This resulted to rendering the estate tax as an ineffective source of revenue. According to data gathered by the Organisation for Economic Co-operation and Development from 1999 to 2015, the tax has historically comprised a very small proportion of all tax revenues. From 2010 to 2015, when total tax revenues consistently hit the Php 1 trillion mark, estate tax revenues (which refer to estate and inheritance taxes category) only ranged from Php 1.45 billion to Php 3.3 billion. That is not even close to comprising 1% of our tax revenues.

Most importantly, the estate tax is anti-business, specifically anti-small business. The effects of this tax should be seen on the lens of micro-enterprises which comprise of 89% of all businesses in the Philippines according to the Philippine Statistics Authority.

According to Section 3a of Republic Act 9178, a micro-enterprise is defined as having assets less than Php 3 million, excluding the land where the business operates. To demonstrate the harmful effects of this tax, let’s use an example.

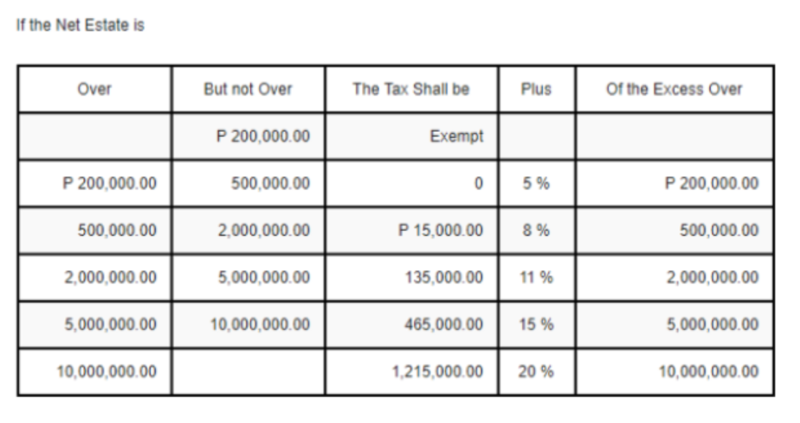

Linda owns a ready-to-wear store that caters to men, women, and children’s wear. Upon her death, it was stated in her last will that the ownership of the store will be passed to her daughter Maria. The total asset value of the store is Php 2.5 million and Linda incurred no debt whatsoever. Therefore, Maria will have to pay estate tax to the Bureau of Internal Revenue (BIR). In our legal parlance, estate tax is not a tax on the property itself, but a tax on the privilege of transmitting property upon the death of the owner. This is our current estate tax bracket as stated by BIR:

To compute how much Maria will have to pay:

2,500,000–2,000,000 = 500,000

500,000 * 0.11 = 55,000

135,000 + 55, 000 = Php 190,000

Php 190,000

That money would have been better spent on renovations, equipment, getting new suppliers, hiring new employees, or even saving up for future long-term expansion. Essentially, the estate tax contributes to retardation of business capital as it represents lost opportunities for firms in using money to invest in their operations.

Speaking of the benefits of an estate tax repeal, the Heritage Foundation conducted a study on the effects of the abolition of the estate tax at the federal level in the US. The study based its projections on a 2015 to 2024 timeframe. Highlights of the study include:

- addition of nearly 18,000 jobs to the economy per annum

- extra USD 2.64 billion per year on private fixed non-residential investment

- additional USD 3.8 billion in consumer spending per year

- extra USD 13.6 billion in effective real capital stock per annum

One can hope that in the future, the DOF or any member of Congress will conduct feasibility studies on the benefits of estate tax abolition and eventually propose the bill on the floor (or in the case of DOF, they will find a Congress member to endorse their study). The Duterte administration promised that tax reform will result to the benefit of all Filipinos. An abolition of the death tax will contribute to that.