THE ECONOMIC situation of the Philippines was discussed in varying perspectives in “Growth in Perspective: A Forum on Economics and Governance” on November 10 at the Leong Hall Auditorium.

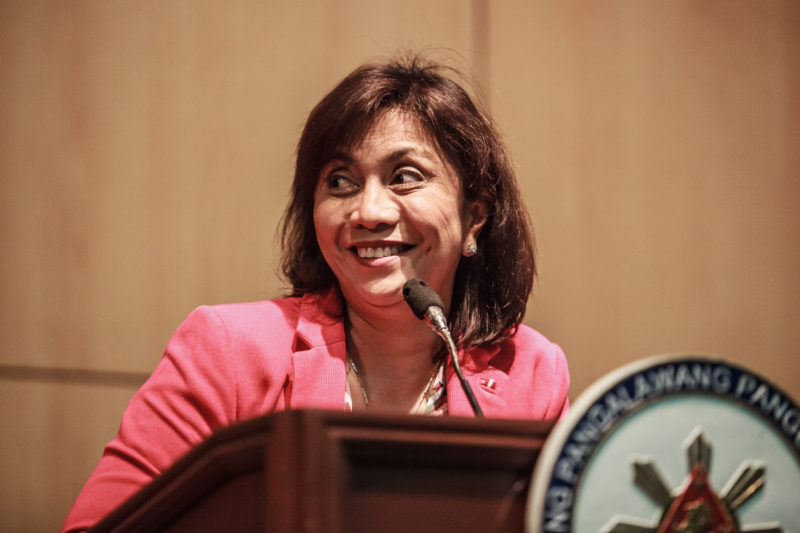

Vice President Leni Robredo, Department of Finance (DOF) Undersecretary Karl Kendrick Chua, and Congressman Teddy Baguilat served as the speakers of the forum.

In their speeches, Robredo, Chua and Baguilat discussed the vital role of economics in alleviating poverty, reforming the country’s tax system and in the lives of the indigenous peoples, respectively.

The forum was organized by two Political Science classes in partnership with the School of Social Sciences Sanggunian.

Revisiting history

Following the Supreme Court’s (SC) ruling on the burial of former President Ferdinand Marcos, Robredo explained the correlation between the country’s history and its economy.

“The issue of the Marcos burial is quite relevant to this afternoon’s discussion. We cannot talk seriously about the Philippines’ growth prospects without considering as well the depth and scope of our country’s history,” she said.

She further explained that it is necessary to discuss and heal the wounds of the past in order to be able to focus on moving forward.

“We must honor the memory of those who fought for the country and demand justice from those who betrayed it and really it is the lessons of the past along with the knowledge and insight that will lead us to future action. This is true in every aspect of our lives,” she said.

In response to the SC’s decision, Robredo reiterated that there is more to simply following the law and that there should be consideration to the country’s collective welfare.

“Reflection and discernment must always precede action,” Robredo said.

DOF proposes tax reform

DOF Undersecretary Karl Kendrick Chua presented the department’s proposed tax reform program, which aims to reduce poverty over the years by “sustaining our economic growth”, and plans to shift the source of growth from consumption to investment.

The DOF also plans to arrive at a “simpler” and “more fair tax reform” that promotes investment and job creation alongside poverty reduction. Their tax reform program is composed of six packages, which include reducing personal income tax.

“I want to help the government make a tax system that is far better than the one we currently have,” Chua said.

He then presented statistics on gasoline excise, and later explained that he wanted to protect low income Filipinos from higher fuel excise. He also discussed different value-added tax exemptions, which indicated “a lot of leakages.”

Chua also added that most people are not interested in tax reform until they hear the benefits and noted that benefits of their proposed tax reform include improved equity in the tax system by shifting the burden to the rich, and more money for the people, by giving money back to the poor through cash transfer.

Indigenous peoples and the economy

Baguilat in his speech emphasized on the difficulties faced by the indigenous peoples in adjusting to the country’s current economy.

“Pagdating sa adjusting to climate change… we can say that the indigenous peoples are very resilient. Pero pagdating sa mga pagbabago sa ating ekonomiya, especially in the economic systems and political systems of the country, nahihirapan ‘yung indigenous peoples.” Baguilat said.

Baguilat recalled how the value of money was “irrelevant” back in the days of their Ifugao ancestors. Unlike today, Ifugaos start depending on money to maintain the rice terraces.

“Wala pang piso noon. (There was no peso yet) People were able to maintain the terraces, they were able to feed themselves, they were able to provide for their needs through the bayanihan system,” he said.

Furthermore, he narrates how the cash economy caused a “culture shock” to the indigenous peoples.

As an example, he made mention of the conflict that happened among tribal leaders in Surigao due to the division of royalties.

According to the Indigenous Peoples Rights Act, the rights of the IPs to their ancestral domain is recognized. This law also demands that IPs must first give consent to those interested in entering their ancestral domain.

In addition to that, IPRA also grants the IPs at least 1% royalty coming from the excise taxes.

“So culture shock from people who have been satisfied with more or less moneyless, cashless economy and then suddenly they were called millionaires. Anong resulta? Nag-away-away sila.”

Baguilat also noted that despite the having IPRA in place, there were still a lot of problems facing the IPs.