“Palagi tayong matatalo.”

According to Asian Institute of Management Policy Center Executive Director Ronald Mendoza, PhD, this will be the effect of political dynasties in the Philippines.

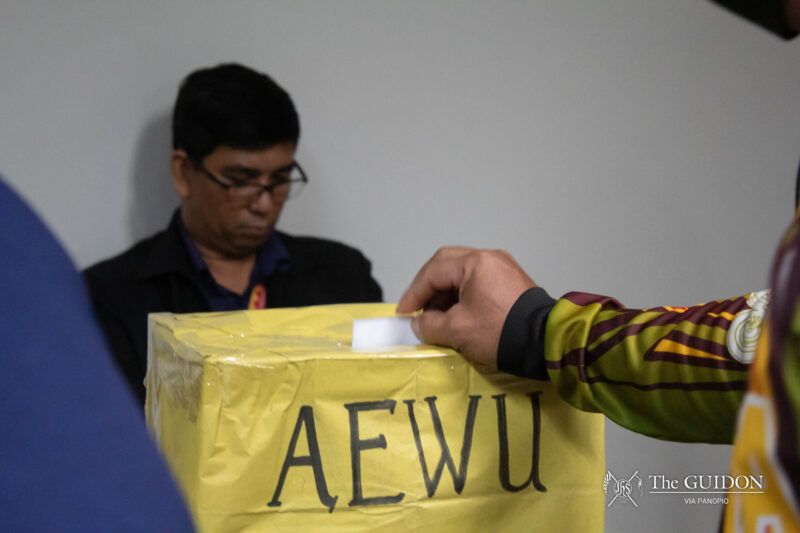

Mendoza was among the three speakers for the Ateneo Economics Association’s (AEA) forum held on January 17 at the Escaler Hall.

The forum, entitled “Sowing Good Governance for a Robust Industrial Economy,” focused on how the absence of good and strong governance—due to graft and corruption—cripples economic growth.

The other speakers included former San Fernando City Mayor Oscar Rodriguez and Economics Department Chairperson Luis Dumlao, PhD.

Dumlao filled in for Albay Governor Jose Ma. Clemente Salceda, who was unable to make it to the event because inclement weather resulted in the cancellation of flights.

Effects of political dynasties

Mendoza and Dumlao discussed the economic and political implications of the existence of political dynasties.

They said that the Philippines remains one of the most corrupt countries in the world, ranking 105th among 176 countries, based on the Corruption Perceptions Index reported by Transparency International (TI) in 2012.

According to Mendoza, the 2012 TI report said that political parties are perceived as the most corrupt institution in the country.

In the same report, more than 60% of respondents said that personal relationships are needed to attain employment.

Mendoza pointed out that the Philippines is not generating the “right type” of leaders due to the prioritization of personal relationships or connections.

“What kind of a society or an economy will we produce in that system? Will the best and brightest lead us? Will we allocate resources according to who can do it best? Will we send signals to foreign investors that we are ready to compete?” he asked.

In an interview with The GUIDON, Dumlao explained how big families are convincing small investors into capitalizing their companies.

“There’s a tendency of expropriation, which means small investors can actually own more than 50% of a company, therefore majority [has] zero control. Definitely, they expropriate, but it’s not inclusive growth [and] inclusive investment,” he said.

“Why nations fail”

Rodriguez distinguished inclusive growth from extractive growth in terms of economics. He said that inclusive growth is defined as a shared growth.

“It must be distributed among the majority, who are the poor people,” he said.

“Why [do] nations fail? It’s because those nations who failed had extractive growth, [which means] only a few benefit from the majority,” Rodriguez added. As an example, he also cited the economic growth during the administration of former President Ferdinand Marcos.

Mendoza emphasized how detrimental extractive growth is to an economy.

“If you keep industries controlled and protected [to take] advantage of [the money of the] domestic population, then you have fewer choices, fewer competitions and lesser innovation,” he said.

Mendoza pointed out the correlation between corruption and growth. “If there’s growth, there’s money. If there’s money, corrupt officials will rise due to exploitation of extractive institutions,” he said in mix Filipino and English.

Meanwhile, for Rodriguez, good governance originates from “shared responsibility” from the government to effect transparency and efficient governance.

“It (inclusive growth) will provide more opportunities to the poor and vulnerable, reduce poverty and attract more foreign investments, tourists and [different] people in the government,” he said.