CLOSING AT a rate of P41.05 against the United States Dollar (USD) last December 28, the last trading day of 2012, the Philippine peso has all in all appreciated 6.53% since January 2, the first trading day for the said year. This makes the peso the best performer among Southeast Asian currencies.

The peso’s best finish in 2012 was last December 8, when it closed P40.862 to a dollar. Last November 27, it reached the P40-level for the first time since March 2008, closing P40.870 against the greenback.

However, while it is now touted as Asia’s best performing emerging currency, the government and various sectors have become wary of the peso’s continued rise.

Gut-level economics

Out of all of the economic figures, the peso–dollar exchange rate is arguably one of the closest to the gut of the common Filipino. Millions of families rely on remittances sent by overseas Filipino workers (OFWs). For them, a weaker peso is better because it means more money for every dollar that their relatives send home.

Ironically, one of the major factors contributing to the peso’s appreciation is the increase in remittances sent by OFWs. Exchange rates reached the P56-level in 2005, reflecting the turbulent socio-political and economic situation then. Nevertheless, this became attractive for OFWs as their dollars would be worth more. As more remittances came in and conditions in the country gradually improved, the peso continually appreciated.

Today, amid the gains of the Aquino administration and record remittances sent by OFWs, it seems that the peso will only get stronger. Bank of America–Merrill Lynch, in its most recent research note, expects the Philippine peso to level at P41 per USD in the first quarter of 2013, before appreciating further to P39.80 for the remainder of the year.

Connected to this, Rappler reported that during the press conference held on November 28 to announce the 7.1% gross domestic product (GDP) growth of the country for the third quarter of 2012, Socioeconomic Planning Secretary Arsenio Balisacan said, “The slow recovery in the US economy continues to affect us negatively as their monetary authorities try to prop up their economy through quantitative easing. This, together with our strong macroeconomic fundamentals and good economic prospects, has resulted in the appreciation of our currency threatening to erode our competitiveness.”

Double-edged sword

Balisacan is worried that the peso’s rise will “erode our competitiveness,” the Rappler report said. Aside from OFWs, Balisacan also cited exporters as one sector that could be badly hit.

A stronger peso could mean less profit for our local exporters. The peso’s appreciation will make the country’s exports more expensive and will thus lower international demand for exported products. Lower demand for Philippine products will lead merchandise exporters to consider laying off workers or closing down permanently.

As reported by Rappler, Balisacan noted that the peso’s appreciation will “make Philippine-made products expensive abroad, erode the purchasing power of OFW remittances, reduce exporters’ earnings, encourage the flow of hot money or investments in stocks and bonds and threaten local firms’ earnings through cheaper imports.”

“We have to be worried by the appreciation of the peso because it affects the lives of ordinary people, it affects employment,” Balisacan told Rappler.

With lower exchange rates, local investors will now also be more conservative when investing in the USD. The US’ former reputation as an investor’s haven is now said to be corroding with its declining economic power.

Hopeful break from liabilities

Meanwhile, the peso’s strength can help solve a pressing problem for the Philippines. The national government’s total debt ballooned to P5.213 trillion in September 2012—a P342.23 billion gain from P4.87 trillion in 2011, thereby increasing the debt of each Filipino to P55,457.

“The P5.2 trillion is about half of the annual GDP and this gives us an idea of its size and the government’s debt obligation,” said Economics Department Chair Luis Dumlao, PhD.

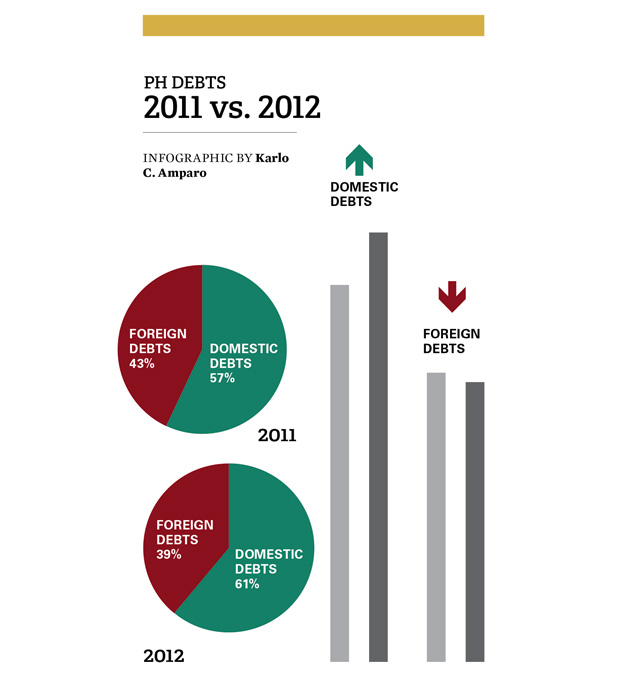

Out of the said amount, 61% comes from domestic debts at P3.184 trillion, P404 billion higher from P2.78 trillion in 2011, while 39% was sourced from foreign debt at P2.028 trillion, P61 billion lower from P2.089 trillion in September 2011.

Most of the foreign debt the Philippines owes is in USD. Thus, a stronger peso would lower the value of these debts. “The debt will decrease by roughly P60 billion per peso appreciation, say, from P41 to P40 per USD,” Dumlao said.

Getting out of the debt sinkhole

Despite such developments, Dumlao stressed that the country should direct its efforts in making sure its fiscal house is in order.

“The Philippines should concentrate more on outgrowing the debt. If young John Gokongwei had concentrated too much on balancing the budget and did not borrow, there would not have been the successful Robinsons group of companies. Mr. Gokongwei is still in debt… but he certainly outgrew his debt,” said Dumlao.