Only the government reserves the power to impose tariffs or taxes; no other entity can do so. Economically, taxation is a reliable mechanism to boost funds that may be spent for the general welfare of the citizens of the country.

November 20 saw the approval of the Sin Tax bill, which was favored by 15 senators and opposed by two. Stipulated in the said bill is the increase of excise taxes on tobacco and alcohol, considered as “sin products.” Certified as urgent by the Aquino administration, the bill has advanced closer to becoming a law and its passage will generate an additional P40 billion in government funds per year.

While health groups lauded the victory in the Senate, critics and skeptics remained staunch in their position and raised points that are obvious and relevant in the same breath. Tobacco companies have warned that massive lay-offs loom, while others have predicted that a black market for the sin products is not unlikely to burgeon—all conceivable and plausible.

The Aquino administration touted the Sin Tax bill for the prodigious fiscal returns and social gains it will produce. The revenue eked out from the bill will be used for universal health care, which will benefit millions of Filipinos, especially the impoverished.

Moreover, the revenue generation may help bolster the government’s efforts to cement financial confidence and stability to its name. After all, the current administration is gunning for yet another credit rating upgrade to an investment level which gives foreign investors the green light for establishing businesses on Philippine shores.

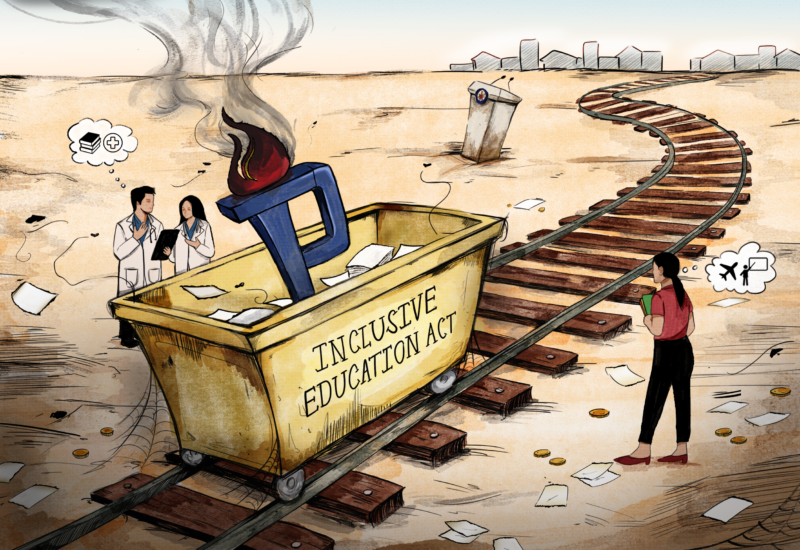

Indubitably, benefits from the Sin Tax bill outweigh the costs in theory, but the execution of the bill once enacted into law may become the bugbear at hand. As it stands, the government has yet to completely clean up the culture of corruption and dishonesty in the country. Tycoons and even owners of small-scale enterprises get away scot-free without paying the right amount of taxes.

Although passing bills that generate more revenue for the government is hardly myopic, the government cannot simply carry on making more revenue-boosting bills without ascertaining that the way it collects revenue is, at the very least, clean and efficient.

Such bills either make or break the government and its credibility. On the one hand, if the government strictly monitors the collection of taxes, stringently metes out sanctions on those who evade taxes, and transparently uses the funds for the welfare of the citizens, then the government will gain more public confidence and, more importantly, public trust.

On the other hand, if the government fails to police its tax-collecting systems, then the revenue-boosting bills will fall prey to scheming politicians who pilfer by the millions, and businessmen or other ordinary citizens who will simply foist receipts with fake figures.

The government indeed reserves the right to control taxation, for as long as everybody is made to pay what he or she should and the funds are used for the country’s betterment. However, there is something undoubtedly wrong when taxes pile up but nothing improves.