GOING BEYOND the usual discussions on finance, the 3rd National Student-Investors’ Convention (NSInC) touched on the local industries that are worth investing in, with the aim of encouraging young and upcoming entrepreneurs to invest in their own country.

GOING BEYOND the usual discussions on finance, the 3rd National Student-Investors’ Convention (NSInC) touched on the local industries that are worth investing in, with the aim of encouraging young and upcoming entrepreneurs to invest in their own country.

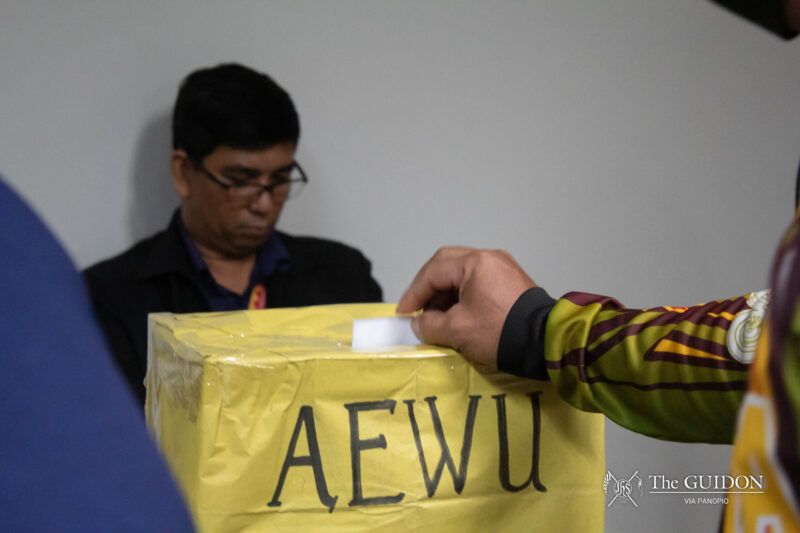

NSInC is an annual event by the Ateneo Management Economics Association (MEcO). It brings together students from various Metro Manila universities to discuss and analyze a range of national issues, especially in the aspect of investment.

Guest speakers include Senator Dick Gordon, Minette Navarrete from Globe Telecom, former Department of Agriculture secretary Luis Lorenzo Jr, Consultant-Entrepreneur Aleem Guiapal and Gawad Kalinga founder Tony Meloto. It was held on November 20 at the Leong Hall Auditorium.

The ‘what nows’

Themed “The Next Best Thing: Investment Potential in Philippine Industry,” this year’s NSInC tackled Philippine macro-economy in the perspective of different industries, according to MEcO Vice President for Investment Strategies Angela Isabelle Poe.

She said that in the past years, NSInC focused on the “how to’s” of investment in stocks in other instruments. This was why, this year’s convention will be different, focusing mainly on the “what now’s” of the country.

“This [year’s NSInC] aimed to provide background and insight that would answer ‘what nows’ in some of the country’s most critical economic drivers,” Poe added.

The discussions in NSInC focused on seven profitable industries in the Philippines—tourism, real estate, agriculture, financial services, telecommunications, mining and social entrepreneurship.

These industries are local growth sectors identified by the Joint Foreign Chambers. The Joint Foreign Chambers is composed of chambers of commerce from the United States, Australia, New Zealand, Canada, Europe, Japan, Korea and the Philippines.

The group aims to identify the seven domestic sectors where the Philippine government and private institutions can work together.

Worth Investing in

According to Poe, the industries in the Philippines have investment potential.

Gordon, who was a speaker for the Tourism industry, agreed and said that the Philippines does not flourish because of the people’s apathy and indifference. He added that Filipinos choose to patronize foreign products and businesses instead of the country’s own.

Meanwhile, Navarrete, a speaker for the Telecommunications industry, said that “the Philippines is a wonderful market. Anything with a community and viral, I will invest [in].”

Navarrete added that virals and the internet was a territory business investors could further explore, since these enable interaction with the potential consumers.

“Social networking sites are popular because we like to announce our whereabouts, our lives and promote our causes. They serve as tools that enable us to participate more,” she said.

Poe added that student entrepreneurs can help harness the country’s investment potential. “Whether in actual economic output or just the culture of productivity, they would be helping the [Philippines] along the right path,” she added.

Not just for profit

Not just for profit

Poe said that it is important for students to have knowledge of the country’s investment climate because once you are familiar with the economic situation in the country, you would know how to “play the game.” She added that, then, money-making would be easier.

Navarrete also gave advice to the students. She said that local industries are worth investing in since there are a lot of opportunities in the Philippines. She encouraged students to “give back to the community because that’s where the real value is.”